New Zealand

View updates

View updates

Summary

Navigating the global tax compliance landscape successfully is complex and resource-intensive. Every country has a specific and constantly evolving set of legislated e-invoicing requirements.

Non-compliance, intentional or not, can result in significant financial penalties, business disruption, and reputational damage.

Updates

11.17.22

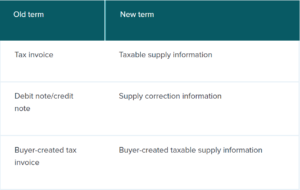

| Note that: businesses will not be required to change the wording on their tax invoices to reflect the new terms.

Note that: businesses will not be required to change the wording on their tax invoices to reflect the new terms.

04.28.22

|